Stader Labs Staking - Stader Labs Wallet

Welcome to Stader Labs, where innovation meets security in the world of Decentralized Finance (DeFi). As a pioneering technology company, we’re committed to developing solutions that push the boundaries of what’s possible in the DeFi landscape. From smart contract platforms to automated liquidity provision, Stader Labs aims to make DeFi more accessible, efficient, and secure for everyone. Securely store, manage, and transfer your digital assets with our user-friendly wallet app, which features multi-chain support and real-time analytics.

Manage all your assets conveniently in one place with our secure and intuitive digital Stader Labs wallet.

How Stader Labs Works

Stader Labs allows users to stake tokens, receive liquid tokens, and participate in various DeFi activities—all from one centralized dashboard. Let’s delve into how Stader achieves this trifecta, making DeFi more accessible and rewarding for users at all levels of experience.

Stake Tokens Seamlessly

Step 1: Connect Your Wallet

Before you begin, connect your digital wallet to the Stader platform. Make sure your wallet is compatible and has the necessary security features like two-factor authentication (2FA) enabled.

Step 2: Choose Your Tokens

Select the type of tokens you want to stake. Stader supports multiple blockchain assets, providing you with a diversified portfolio right from the get-go.

Step 3: Confirm Staking

After selecting your tokens, proceed to confirm the staking operation. You’ll be prompted to review the transaction details, such as the amount and the expected yield.

Step 4: Transaction Confirmation

Once you confirm the staking operation, Stader’s smart contracts automatically allocate your tokens to the selected staking pool, completing the process and you will earn staking rewards.

Receive Liquid Tokens

Step 1: Staking Confirmation

After successfully staking your tokens, Stader’s platform will issue you corresponding liquid tokens. These liquid tokens represent your staked assets but offer additional liquidity.

Step 2: Freely Trade or Utilize

These liquid tokens are not locked and can be used for trading or participating in other DeFi activities, allowing you to maximize the utility of your assets.

Participate in DeFi

Step 1: Browse DeFi Opportunities

Stader’s platform provides a curated list of various DeFi activities you can participate in, such as yield farming, liquidity pools, and decentralized exchanges (DEX).

Step 2: Use Liquid Tokens

You can use the liquid tokens more then 40+ DeFi protocols received from staking to enter into these DeFi protocols. This enables you to earn rewards on multiple fronts—both from staking and other DeFi activities.

Step 3: Manage and Optimize

Stader provides real-time analytics and performance metrics, allowing you to keep track of your investments and optimize your strategies accordingly.

Stader Labs Supported Networks.

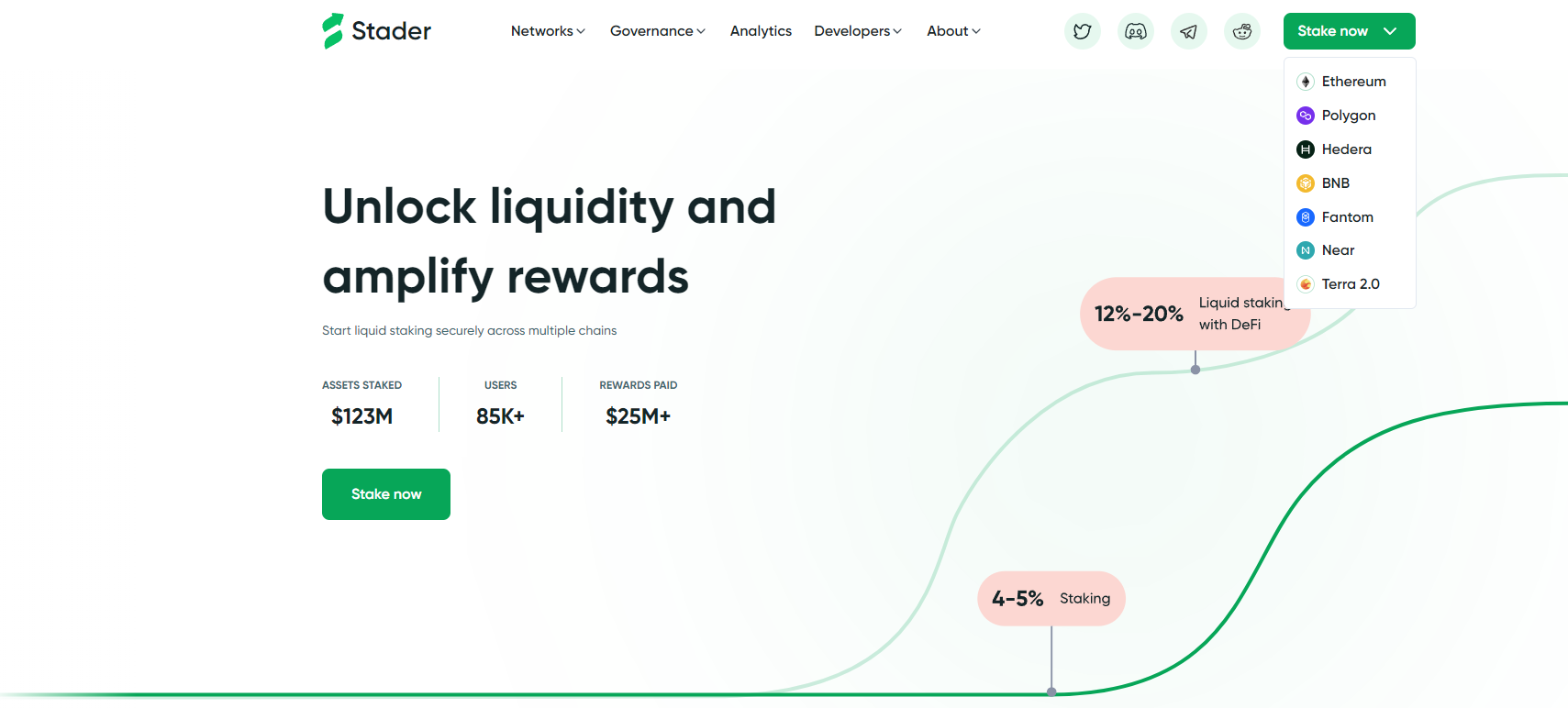

Recognizing this, Stader Labs offers a multi-chain platform that seamlessly integrates with a range of blockchain networks like Ethereum, Polygon, Hedera, BNB, Fantom, Terra 2.0 and Near. Stader Labs ensures you don’t have to compromise. Below, we explore the networks supported by Stader Labs and what they bring to your DeFi journey.

Ethereum

Why Choose Ethereum on Stader: Enjoy a wide variety of staking and yield farming opportunities, along with the robust security that Ethereum’s decentralized network offers.

Polygon

Why Choose Polygon on Stader: Ideal for those who want to participate in the Ethereum ecosystem without the high transaction costs, making DeFi more accessible.

Hedera

Why Choose Hedera on Stader: If you prioritize speed and minimal transaction costs, Hedera on Stader provides an efficient way to partake in DeFi activities.

BNB (Binance Smart Chain)

Why Choose BNB on Stader: With an array of native tokens and dApps, BNB on Stader Labs is perfect for those looking to diversify their DeFi portfolio cost-effectively.

Fantom

Why Choose Fantom on Stader: If you’re looking for a network that combines speed with security, Fantom’s compatibility with Stader Labs provides an ideal solution.

Terra 2.0

Why Choose Terra 2.0 on Stader: If stable assets and complex DeFi applications appeal to you, then Terra 2.0’s features, combined with Stader’s interface, offer an advanced DeFi experience.

Near

Why Choose Near on Stader: If you’re new to DeFi and are looking for an accessible entry point, Near’s user-friendly interface and Stader’s platform make for an easy start.

Stader Labs Hbar staking service provides a secure, efficient, and user-friendly way to maximize your returns from Hedera Hashgraph. Staking in the decentralized finance (DeFi) world just got more exciting with Stader Labs extending its services to include Hedera Hashgraph, commonly known as Hbar. If you hold Hbar tokens and have been exploring ways to stake them securely and effortlessly, Stader Labs Hedera Staking offers you the perfect platform. Below is a comprehensive guide on what makes Hbar staking with Stader Labs an optimal choice.

About : Stader Labs Staking

Stader Labs is on an ambitious journey to democratize decentralized finance (DeFi) with its “1 Billion Mission.” The goal is audacious but clear: to bring 1 billion people into the world of staking and DeFi. Stader aims to break down the complexities that often deter newcomers, offering a user-friendly platform where earning staking rewards and participating in DeFi becomes not just simple but convenient. By supporting multiple blockchain networks and integrating a plethora of financial services, Stader intends to make DeFi accessible to a broader audience, thereby achieving its mission to expand the DeFi user base exponentially.

Conclusion

Stader Labs understands that one size doesn’t fit all in DeFi. By offering support for a diverse range of blockchain networks—each with its unique features and benefits—Stader Labs ensures you can tailor your DeFi activities to meet your specific needs. Liquid staking is not merely an advancement; it’s a paradigm shift. With its ability to unlock liquidity without sacrificing attractive staking rewards, it stands as a transformative innovation in the DeFi sector. The impressive metrics—$123 million in assets staked, 85,000+ users, and $25 million in rewards paid—only validate its rising prominence. If you’re looking to maximize your financial agility without missing out on staking benefits, it might be time to dive into liquid staking across multiple chains.